Playing Games

Investors

investor

THOMAS BARWICK—GETTY IMAGES

a person who buys pieces of a company (or other asset) in order to make a profit

(noun)

The company had an important meeting with its investors.

think carefully about the stocks they buy. Usually, they buy a stock because they think the business will grow and the stock price will go up. Take Amazon. During the pandemic, people ordered more items online. They did a lot of that ordering through Amazon. That’s one reason Amazon’s stock price went up about 50% in the past year. People who bought Amazon stock and then sold it made money.

THOMAS BARWICK—GETTY IMAGES

a person who buys pieces of a company (or other asset) in order to make a profit

(noun)

The company had an important meeting with its investors.

think carefully about the stocks they buy. Usually, they buy a stock because they think the business will grow and the stock price will go up. Take Amazon. During the pandemic, people ordered more items online. They did a lot of that ordering through Amazon. That’s one reason Amazon’s stock price went up about 50% in the past year. People who bought Amazon stock and then sold it made money.

But GameStop is a very different story. In January, its stock price soared (see “Story of a Stock”). It went from $17.25 to $325. This is almost an 1,800% gain. But the increase wasn’t based on the business. Like many companies with physical stores, GameStop’s business during the pandemic has been bad. More people are shopping for video games at home. (We bet you knew that already!) Sales at GameStop stores fell. The company closed almost 500 of them last year. It plans to close hundreds more. So why was there a meteoric

Meteoric

SHIHO FUKADA—GETTY IMAGES

super speedy, like a meteor

(adjective)

The singer was thrilled by her meteoric rise to fame.

rise of its stock price?

SHIHO FUKADA—GETTY IMAGES

super speedy, like a meteor

(adjective)

The singer was thrilled by her meteoric rise to fame.

rise of its stock price?

Long Story Short

Some professional stock traders focused on the fact that GameStop’s business was bad—and they bet on it. Rather than buying the stock because they believed it would go up, they used their money to bet it would go down. This is called “short selling.”

When traders sell short, they first borrow shares from someone who owns them. The traders sell those shares. If the stock price falls, they buy the shares back at a lower price and return them to the original owner. The money they make is the difference between what they sold a share for and what they bought it back for. (For example, if they sold a share at $100 and bought it back at $90, they’ve made $10.)

But if the stock price rises, they must still return the shares. And they have to buy them back at a higher price to do so. In this case, they lose the difference between what they sold a share for and what they bought it back for. (For example, if they sold a share at $100 and bought it back at $110, they’ve lost $10.)

INVESTMENT APP In January, people used the app Robinhood to buy shares of GameStop on their smartphones.

GABBY JONES—BLOOMBERG; GETTY IMAGES

Group Think

Traders made huge bets, worth billions of dollars, that GameStop’s stock price would fall. And these proved to be bad bets. GameStop’s stock price went up. Why? Because thousands of people—not professional traders, but regular people—wanted it to.

In January, an online group called WallStreetBets started a movement to buy shares of GameStop. The group did this, in part, because some investors believed the company would turn around. But they also wanted to teach professional traders an expensive lesson. And they did. The price started to rise—fast. Those professional traders were forced to buy back the shares they borrowed at much higher prices. That caused the price of GameStop to rise even more. The traders lost billions.

While this strategy might be fun to read about, it’s very risky. After hitting its high, GameStop shares fell 31% on February 1. And the price trended down from there. So if you want to invest in stocks, first try to think about the next Amazon. What companies do you think will be bigger and more successful in five or 10 years? Then, talk to your parents about saving to buy a share or two of those.

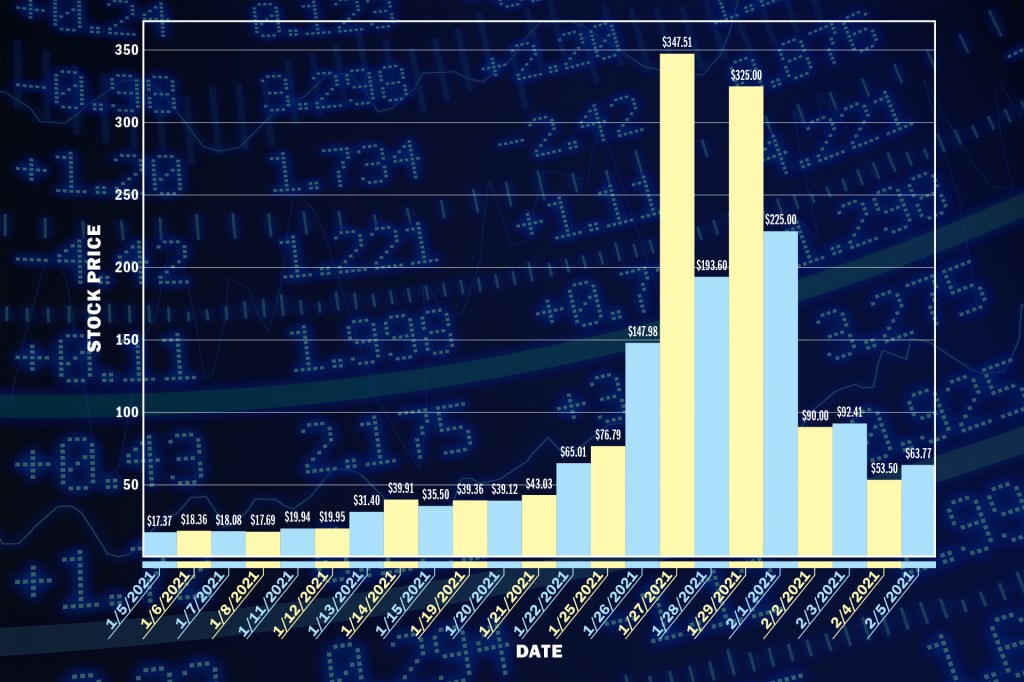

Story of a Stock

A stock chart, such as the one below, shows how the price of a company’s stock changes over time. Sometimes, the price goes up. Sometimes, it goes down. Usually, it stays about the same.

In early January, the price of a share of GameStop was pretty steady. It stayed below $50. Then, on January 22, it went up to $65. And on January 26, it went up a lot—past $147. The next day, it reached $347!

People will be watching GameStop’s stock price to see what happens next. And investors will study its stock chart, and the story of GameStop, for many years to come.

—By Jean Chatzky

Extra! Click here to read a related article from TIME for Kids.